Evolutionary theory predicts that globalization should increase the risk of recession and slow recovery rates, a phenomenon borne out by real data, say econophysicists.

Biologists have long puzzled over the modular structure of living things, a module being a structure that can function relatively independently from other parts of the system. So a module might be an ecology, a society within that ecology, an individual animal, an organ, a cell within that organ, a gene within that cell, and so on.

Nature simply wreaks of modularity throughout its hierarchy. The question, until recently, was why. A couple of years back, Jun Sun and Michael Deem, a couple of of physicists at Rice University in Houston, came up with an answer. They said modularity allows a system to more easily evolve and reduces the chances of catastrophic collapse due to some kind of outside influence, such as climate change or disease.

They went to show that modularity emerges spontaneously in a evolutionary algorithms that change relatively slowly and swap information.

Today Deem and Jiankui He, also at Rice, apply this idea to the global trade network. Their hypothesis is that this network evolves in exactly the same way as natural systems, or at least, that it is constrained in the same way by the rate at which it changes, the fact that information flows within it.

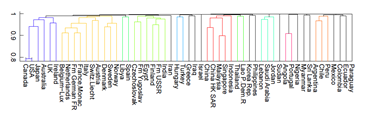

That implies that modular structures ought to form spontaneously on all kinds of scales within this network. And indeed they do in the form of companies, trade groups, countries and so on.

However, globalization is a process that reduces modularity because it encourages an equality of trade between entities in different parts of the world. But in naturally evolved systems, far from increasing the robustness of the system to perturbations, a drop in modularity decreases it. Deem and He hypothesise that the same thing happens in the gobal trade network.

What's surprising is that their idea is actually borne out by the data. They've studied the nature of various global recessions since 1969 and say that the increase in globalization makes the global economy less stable. What's more, when a recession does hit, the recovery becomes slower as globalization increases.

The explanation is that modularity allows a hierarchy to form within a system and this helps a system to recover when trouble strikes. If this structure is absent or reduced in form, then the recovery is slower. Globalization seems to discourage the formation of the kind of trade groups that would form these structures.

Deem and He say the global economy is actually more fragile today than it was 40 years ago.

They also make a prediction. They say that a recession should encourage the formation hierarchies at least temporarily. What they mean is the formation of trade groups who trade preferentially with each other.

That doesn't sound too far fetched and given that the global economy is currently attempting to lift itself out of recession it shouldn't be too hard to test either.

Ref:

arxiv.org/abs/1010.0410: Structure and Response in the World Trade Network